ONLY a fraction of Australians pay more in taxes than they pocket in taxpayer benefits over a lifetime — yet Tony Abbott’s debt tax will punish these very people.

The median Australian household gains $114 a week more in government benefits than it pays in taxes.

On average, a median household pays $348 in taxes each week — yet claws back $103 in welfare payments plus $359 worth of government services in the form of free or subsidised healthcare, education and childcare.

The wealthiest Australians, in contrast, pay an average of $1029 a week in taxes and use $249 worth of government services. The poorest pay $106 a week in taxes — including the GST — but receive $890 in government payments and services.

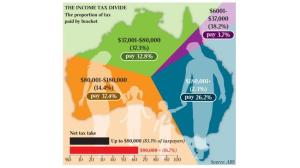

The latest tax office data shows that the 293,540 Australians earning more than $180,000 handed over an average of $129,000 each in income taxes — a quarter of the nation’s total income tax take during 2011-12.

Nearly six million low-income Australians earning less than $37,000 a year paid an average of $1100 each — 3.7 per cent of total income tax revenue.

More than a million of the nation’s poorest people do not pay any income tax because they earn less than the $18,200 tax-free threshold.

The “battlers’’ who earn more than the minimum wage, but less than the average earning of $75,000, pay a third of the nation’s tax bill. Middle-class workers earning more than $80,000 a year pay the rest. The wealthiest 1 per cent of Australians pay 17 per cent of the nation’s income taxes.

Centre for Independent Studies research fellow Simon Cowan said yesterday that most Australians received more from the welfare system than they contributed.

“Most people will receive benefits equivalent to or exceeding their income, tax,’’ Mr Cowan said. “But if you don’t have kids and don’t receive the pension it’s likely you’ll pay more in taxes than you receive in benefits.’’

He said it would be more efficient for middle and high-income families to pay less tax — but then pay for the cost of public services such as health and education. “It’s inefficient for them to pay taxes just to have the government deliver services back to them,’’ he said.

Single Australians at the peak of their earning power — aged from 25 to 44 — pay, on average, $200 a week more in taxes than they get back in government benefits. But the trend reverses for families with children, with the extent of “tax-welfare churn’’ revealed by Australian Bureau of Statistics data.

On average, a working family with a stay-at-home parent and the youngest child at school earns $2023 a week — plus $204 in welfare payments including the family tax benefit.

The typical family consumes another $662 a week worth of government services — including education valued at $412 and $178 a week in health care. The single-income family pays $436 a week in income tax, on average, plus $224 in “production taxes” including $81 on the GST, $14 in alcohol taxes and $20 in fuel taxes.

An unemployed family, in contrast, receives an average of $143 a week in private income — plus $634 a week in cash welfare benefits that include the disability support pension, parenting payments, unemployment benefits and family tax benefits. The jobless family consumes $832 a week in government services, including $428 in education, $207 in health care, $13 in housing subsidies and $3 in electricity concessions.

A typical unemployed family pays just $2 a week in income tax, plus $171 a week in “production taxes’’ — including $62 a week on the GST, $20 a week on tobacco taxes, $14 in fuel taxes and $17 in taxes on food.

A working family with both parents employed earns, on average, $2801 a week in private income and gets $73 in welfare payments — predominantly the family tax benefit or parenting payment.

A dual-income family pays $504 a week in income tax, plus another $273 in production taxes including $100 in GST, $20 in alcohol taxes, $8 in tobacco taxes, $29 on fuel taxes and $23 in food taxes. It consumes $592 a week in government services — mainly education and health.

Single Australians at the peak of their earning capacity pay, on average, $200 a week more in taxes than what they get back in government benefits.

Australian Council of Social Service president Cassandra Goldie said yesterday it was vital that high-income earners helped the disadvantaged. “It’s very important we tackle poverty and inequality, so every child has access to decent healthcare and education,’’ she said.

“Without a progressive tax system, there is a big risk to Australia’s social fabric and also to our economy. We will see increasing inequality and a growing divide between people who are living in poverty and those who are enjoying more wealth than ever before.’’

Two million working-age Australians do not have a job and survive on welfare benefits including Newstart Allowance, disability pension and parenting payments.

Taxpayers Australia spokesman Mark Chapman said bracket creep meant more workers were landing in higher tax brackets as they received pay rises to compensate for inflation.

source: theaustralian.com.au